Stock Trading For Beginners India January 2024: Unveiling The Secrets To Trading Stocks

In the dynamic landscape of the Indian financial market, stock trading stands out as a lucrative yet complex venture. For beginners looking to dip their toes into the exciting world of stocks, understanding the fundamentals is crucial. This comprehensive guide aims to demystify stock trading for beginners in India, providing insights, strategies, and essential tips to kickstart a successful journey.

Table of Contents

What is Stock Trading?

Stock trading involves buying and selling shares of publicly listed companies through stock exchanges. In India, major exchanges include the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

Getting Started: Opening a Demat Account

Before diving into the stock market, beginners must open a Demat (Dematerialized) account, a digital repository for holding shares and securities.

Understanding Stocks and Shares

Stocks represent ownership in a company, and shareholders receive dividends and have voting rights. Beginners must grasp the difference between common and preferred shares and the significance of stock prices.

Navigating the Indian Stock Market

Key Market Participants

Understanding the roles of brokers, market makers, and regulators is crucial. The Securities and Exchange Board of India (SEBI) regulates the Indian stock market, ensuring transparency and fairness.

Market Indices and Sectors

Tracking market indices like Nifty and Sensex helps investors gauge overall market performance. Additionally, focusing on specific sectors can aid in informed investment decisions.

Trading Hours and Market Phases

The Indian stock market operates in specific hours and phases. Beginners should be aware of pre-market and post-market sessions and how they influence stock prices.

Types of Stock Trading

Intraday Trading

Intraday trading involves buying and selling stocks within the same trading day. It requires quick decision-making, technical analysis skills, and a sound understanding of market trends.

Swing Trading

Swing trading spans a few days to weeks, capitalizing on short to medium-term price movements. It’s suitable for those who can dedicate more time to monitoring the market.

Long-Term Investing

Long-term investing involves holding onto stocks for an extended period, often years. It’s a less intensive approach, emphasizing the potential for capital appreciation and dividends.

Essential Tools for Stock Trading

Technical Analysis

Mastering technical analysis tools like charts and indicators is vital. Beginners should grasp concepts like support and resistance, moving averages, and relative strength index (RSI).

Fundamental Analysis

Understanding a company’s financial health, earnings, and growth potential is the essence of fundamental analysis. This method helps investors make informed decisions based on a company’s intrinsic value.

Online Trading Platforms

Choosing the right online trading platform is crucial for a seamless trading experience. Evaluate factors like user interface, security, and transaction fees before making a decision.

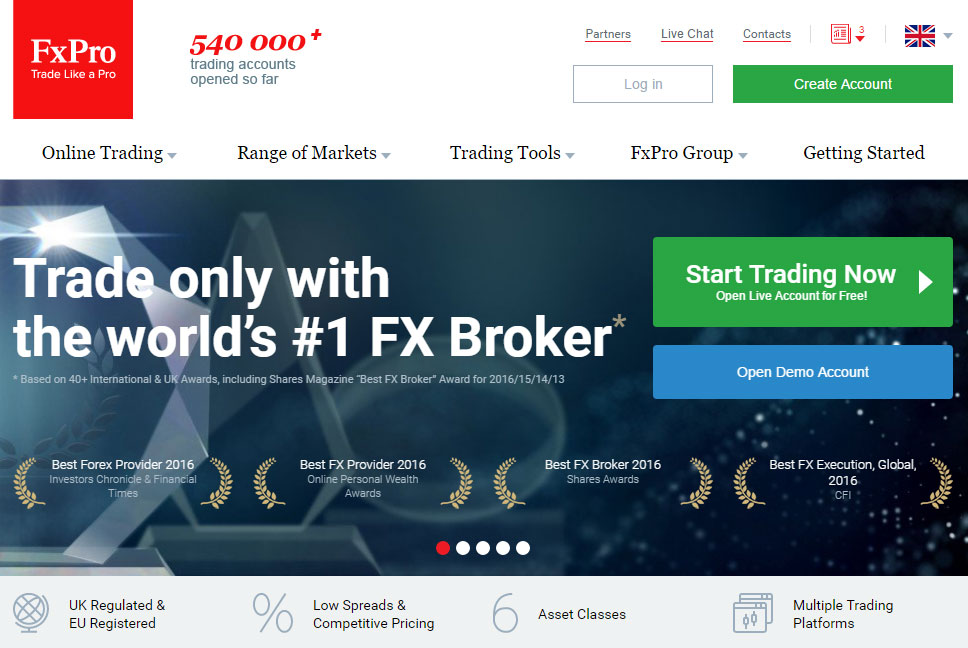

In the realm of online trading platforms, FxPro emerges as a distinguished player, offering a strategic blend of features that align with the needs of both beginners and seasoned traders.

1. Intuitive User Interface:

FxPro’s platform boasts an intuitive and user-friendly interface, ensuring that beginners can navigate seamlessly through the complexities of trading. The clean design and easy-to-use tools make it an excellent choice for those taking their first steps in the financial markets.

2. Top-Notch Security Measures:

Security is a top priority for FxPro, and the platform employs state-of-the-art security measures to protect user accounts and sensitive information. With advanced encryption and authentication protocols, FxPro provides a secure environment for executing trades and managing investments.

3. Competitive Transaction Costs:

FxPro offers competitive transaction costs with transparent fee structures that align with the preferences of different traders. The platform allows users to optimize their trading costs, making it a cost-effective choice for those mindful of transaction fees.

4. Diverse Asset Portfolio:

FxPro provides access to a diverse range of financial instruments, including forex, stocks, indices, and commodities. This diversity allows traders to explore various markets and diversify their portfolios, enhancing the potential for balanced returns.

Making the Strategic Choice: FxPro and Your Trading Success

As you embark on your stock trading journey, the strategic inclusion of FxPro as your chosen trading platform can significantly contribute to your success. The platform’s commitment to user-friendly design, robust security, competitive costs, and a diverse asset portfolio aligns seamlessly with the strategic considerations outlined in this guide.

In the vast ocean of online trading, where the right platform can be the wind beneath your trading sails, FxPro stands as a reliable and strategic choice. Its features are strategically crafted to empower both beginners and experienced traders in their quest for financial success.

The strategic selection of an online trading platform is a pivotal decision in your stock trading journey. By strategically incorporating FxPro into your arsenal, you not only gain access to a cutting-edge platform but also align yourself with a partner committed to your trading success. As the markets evolve, having a strategic ally like FxPro can make all the difference in navigating the complexities and emerging victorious in the world of stock trading. Happy trading!

Risk Management and Strategies

Setting Realistic Goals

Beginners should set achievable financial goals aligned with their risk tolerance and investment horizon. Establishing clear objectives helps in crafting a well-defined trading strategy.

Diversification

Spreading investments across different sectors and asset classes reduces risk. Beginners must understand the importance of a diversified portfolio to safeguard against market volatility.

Risk-Reward Ratio

Calculating and maintaining a favorable risk-reward ratio is essential. This ratio helps traders assess potential losses against anticipated profits, aiding in prudent decision-making.

Common Mistakes to Avoid

Emotional Trading

Emotions often cloud judgment in stock trading. Overcoming fear and greed is critical to making rational decisions and avoiding impulsive actions.

Lack of Research

Inadequate research can lead to uninformed decisions. Beginners must dedicate time to research stocks, market trends, and economic indicators.

Ignoring Market Trends

Ignoring prevailing market trends can be detrimental. Staying abreast of market news and trends is crucial for making timely and informed decisions.

Tax Implications of Stock Trading in India

Understanding the tax implications of stock trading is crucial. Capital gains tax is applicable on profits made from selling stocks, and beginners should be aware of the tax rates and exemptions.

Tax-Saving Instruments

Exploring tax-saving instruments like Equity-Linked Savings Schemes (ELSS) and Tax-Saving Fixed Deposits can help minimize tax liabilities for investors.

The Importance of Continuous Learning

The stock market is dynamic, influenced by various factors such as economic events, geopolitical developments, and company-specific news. Successful traders continuously educate themselves, staying informed about market changes that could impact their investments.

Utilizing Educational Resources

There are numerous educational resources available for aspiring stock traders. Online courses, webinars, and books provide in-depth knowledge about market analysis, trading strategies, and risk management. Engaging with these resources can significantly enhance a beginner’s understanding of the stock market.

Joining Trading Communities

Being part of trading communities and forums allows beginners to learn from experienced traders, share insights, and discuss market trends. Platforms like Reddit, TradingView, and other specialized forums provide valuable information and a sense of community.

Incorporating Advanced Strategies

Options Trading

Options trading involves contracts that give investors the right, but not the obligation, to buy or sell an asset at a predetermined price. While more complex than traditional stock trading, options can be a powerful tool for experienced investors.

Margin Trading

Margin trading involves borrowing funds to increase the size of a trading position. While it amplifies potential profits, it also increases the risk. Beginners should approach margin trading cautiously and be aware of the associated risks.

Algorithmic Trading

Algorithmic trading uses computer algorithms to execute trades at optimal prices and timings. This advanced strategy requires programming skills and a deep understanding of market dynamics.

Adapting to Market Trends

Embracing Technological Advancements

The stock market is evolving with technological advancements. Robo-advisors, artificial intelligence, and machine learning are becoming integral parts of the trading landscape. Understanding and leveraging these tools can provide a competitive edge.

Sustainable and ESG Investing

Environmental, Social, and Governance (ESG) investing focuses on companies with ethical and sustainable practices. This trend is gaining traction globally, and investors may choose to align their portfolios with socially responsible companies.

Global Market Opportunities

With the ease of international investing, beginners can explore opportunities beyond Indian markets. Diversifying into global stocks allows investors to tap into diverse industries and regions.

FAQs:

1. Can I start trading stocks with a small investment?

Yes, you can start trading stocks with a small investment. However, it’s essential to manage risks wisely and choose stocks carefully to maximize returns.

2. How can I stay updated with market trends?

Stay updated by regularly following financial news, subscribing to market newsletters, and utilizing stock market apps that provide real-time information.

3. Is stock trading suitable for long-term financial goals?

Yes, stock trading can be suitable for long-term financial goals. Adopting a long-term investment approach and diversifying your portfolio can contribute to wealth creation over time.

4. What is the significance of technical analysis in stock trading?

Technical analysis involves evaluating historical price and volume data to forecast future price movements. It helps traders make informed decisions based on market trends and patterns.

5. How do I choose a reliable online trading platform?

Choose a reliable online trading platform by considering factors such as user reviews, security features, transaction fees, and the range of stocks and financial instruments offered.

6. Are there tax implications for losses in stock trading?

Yes, there are tax implications for losses in stock trading. Capital losses can be set off against capital gains, reducing the overall tax liability.

7. How can I protect my investments during market downturns?

To protect investments during market downturns, consider diversifying your portfolio, setting stop-loss orders, and holding onto quality stocks with strong fundamentals.

8. Is it advisable to follow stock market predictions?

While market predictions can provide insights, they are not foolproof. It’s essential to conduct thorough research and make decisions based on a combination of analysis and your risk tolerance.

9. What role do economic indicators play in stock trading?

Economic indicators, such as GDP growth, interest rates, and inflation, can impact stock prices. Understanding these indicators helps investors make informed decisions about market trends.

10. How do I handle emotions like fear and greed in stock trading?

Handling emotions in stock trading requires discipline and a predefined strategy. Stick to your trading plan, set realistic goals, and avoid making impulsive decisions based on emotional reactions.

11. Can I trade stocks without a broker?

No, you cannot trade stocks without a broker. Brokers act as intermediaries between investors and stock exchanges, facilitating the buying and selling of stocks.

12. What is the role of dividends in stock investing?

Dividends are a portion of a company’s profits distributed to shareholders. Investing in dividend-paying stocks can provide a steady income stream and contribute to long-term wealth accumulation.

Embarking on the journey of stock trading for beginners in India involves continuous learning, adapting to market trends, and developing a disciplined approach. This guide has covered the fundamentals, strategies, and advanced concepts to equip aspiring investors with the knowledge needed to navigate the complexities of the stock market.

Remember, successful stock trading is not about predicting the future but making informed decisions based on research, analysis, and a clear understanding of your financial goals. Whether you’re a long-term investor or an active trader, the key is to stay informed, be adaptable, and approach the market with a well-thought-out strategy.

As you embark on your stock trading journey, keep learning, stay patient, and embrace the challenges and opportunities that the dynamic world of stock markets presents. May your investments be rewarding, and your journey be filled with growth and financial success.

Embarking on the journey of stock trading for beginners in India requires a solid understanding of market fundamentals, strategies, and risk management. By delving into the intricacies of stock trading, aspiring investors can navigate the market with confidence and work towards achieving their financial goals. Remember, successful stock trading is a continuous learning process that demands discipline, patience, and a proactive approach to market dynamics.